Probe Research's annual survey of Manitoba business owners and managers finds a significant proportion of Manitoba businesses are expecting the worst in the coming year.

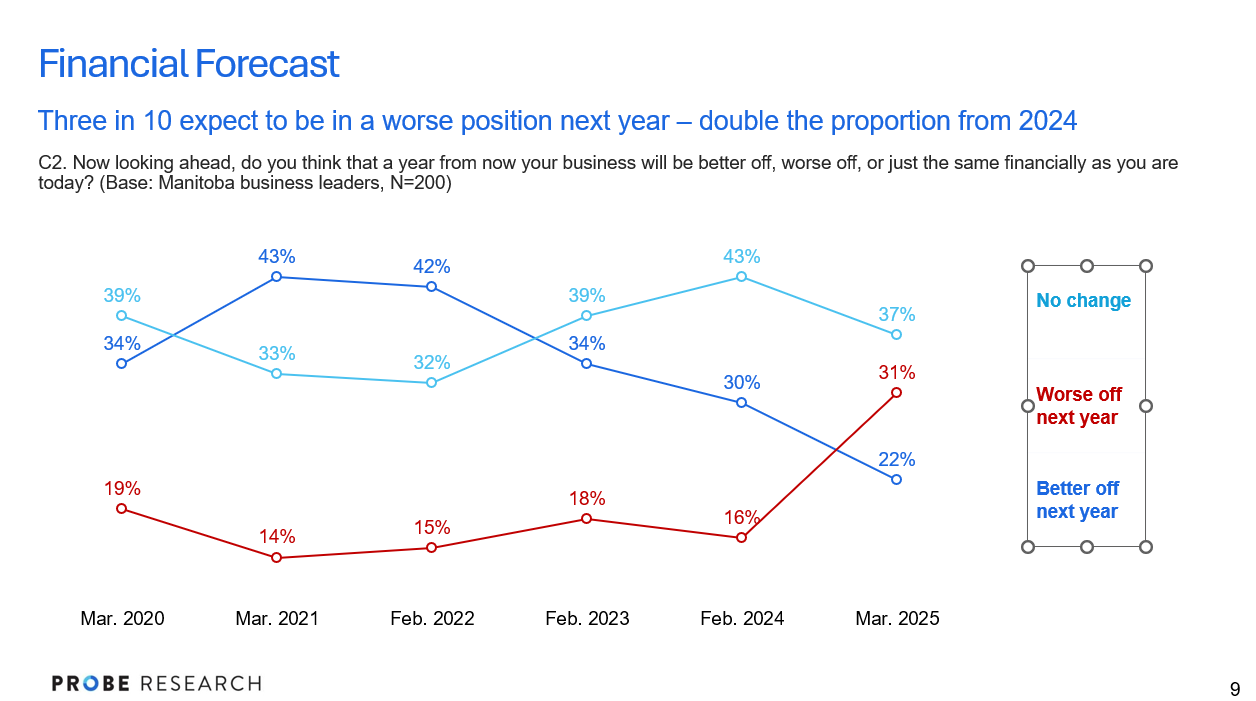

While year-over-year business performance is relatively consistent, more than three in 10 Manitoba business leaders expect to do worse in the coming year – more than twice the proportion that said this in early 2024. The proportion who expect to be better off at this time next year fell from 30 per cent in early 2024 to just 22 per cent today. Optimism about the economic future of Winnipeg remains stable and relatively low (44%, -1% vs. 2024), while those in rural and northern Manitoba express similar levels of confidence in their own community’s economic fortunes.

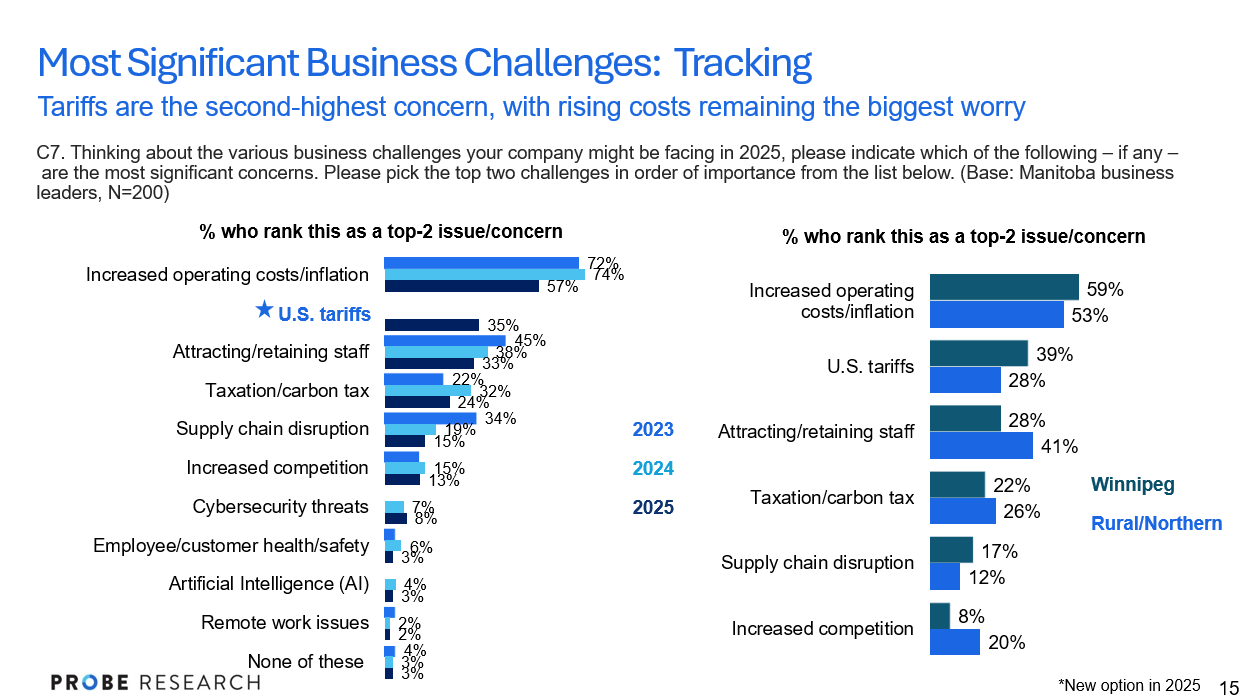

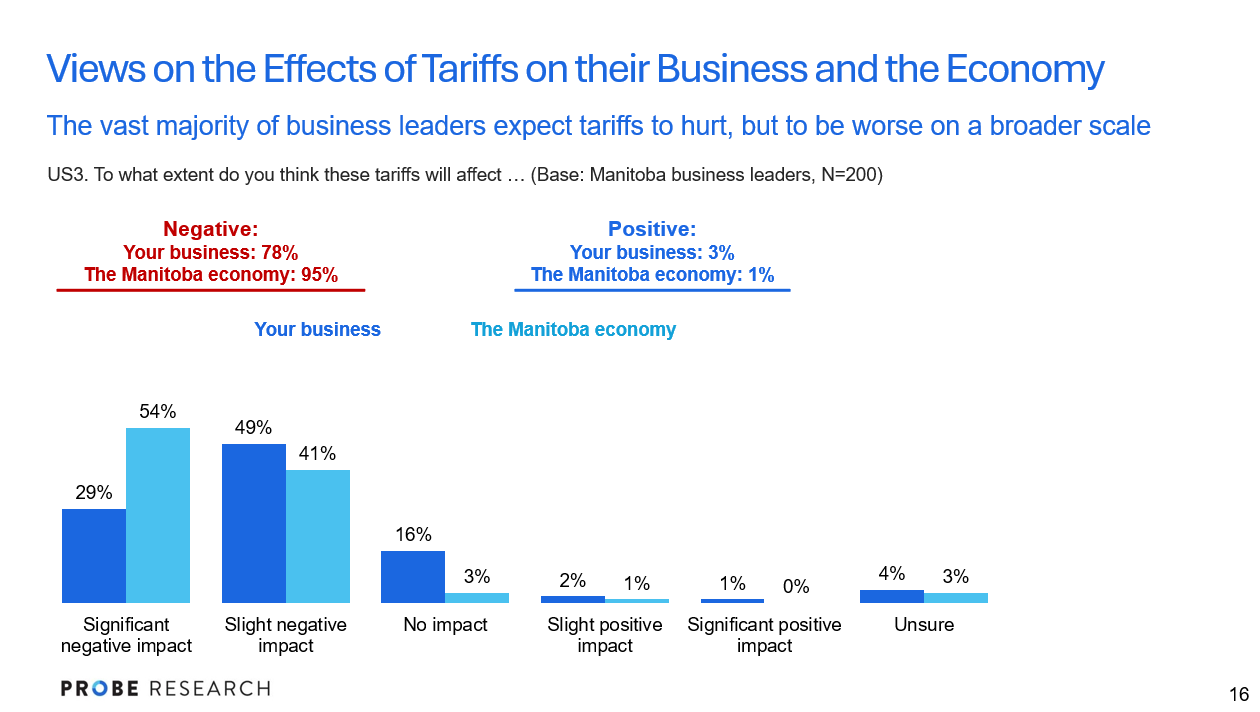

The impact of U.S. tariffs is a major concern, with most expecting this to wreak a very negative effect on the economy. While higher costs remain businesses’ top concern, fully one-third indicate U.S. tariffs are the issue they worry about most. Three-quarters of Manitoba businesses think these tariffs will have a negative effect on their business, with nearly all (95%) agreeing they will have a negative impact on the provincial economy. Businesses are most likely to have postponed investments or delayed hiring in response to these tariffs, with only a very small number noting they are moving (or might move) production to the U.S. Eight in 10 also agree the Trump presidency will have a negative effect on the Canadian economy.

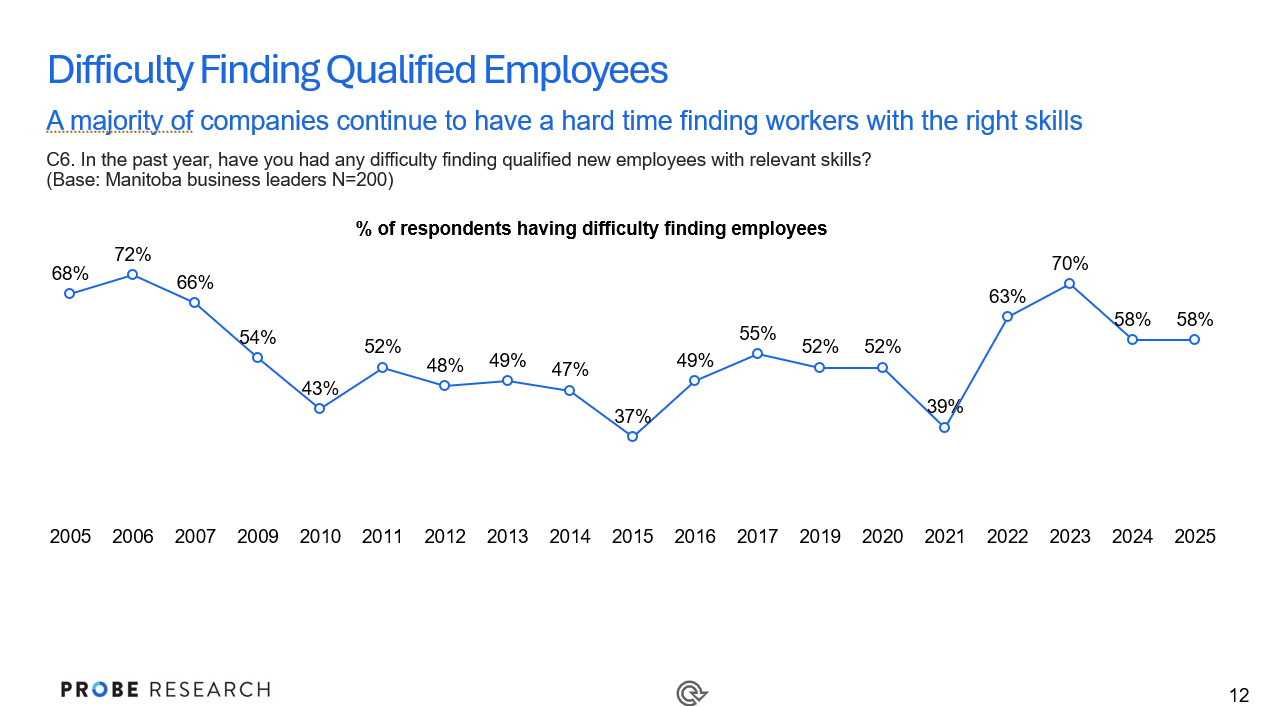

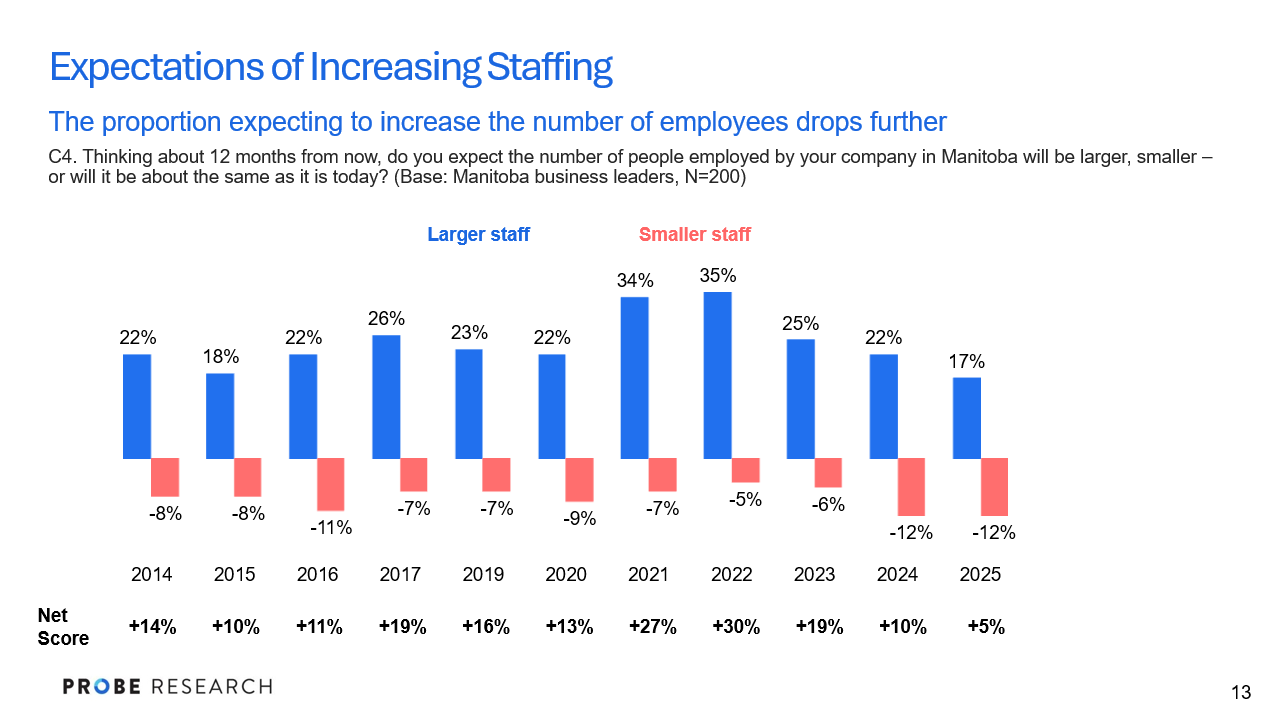

Demand for workers is soft, but there is still high demand for employees with the right skills. Nearly six in 10 employers (58%) continue to report having a hard time finding qualified employees. While demand for skilled workers is lower than it was right at the end of the COVID-19 pandemic, it remains higher than it was for much of the preceding decade. Meanwhile, fewer than one in five (17%) expect to hire more employees in the coming year – the lowest level recorded in the past 10 years. More than one in 10 (12%) expect to have fewer staff at this time next year.

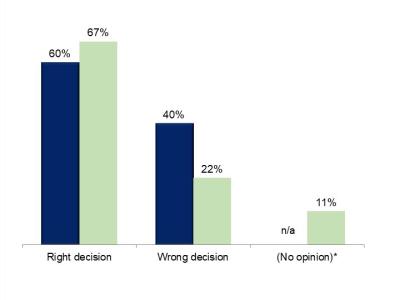

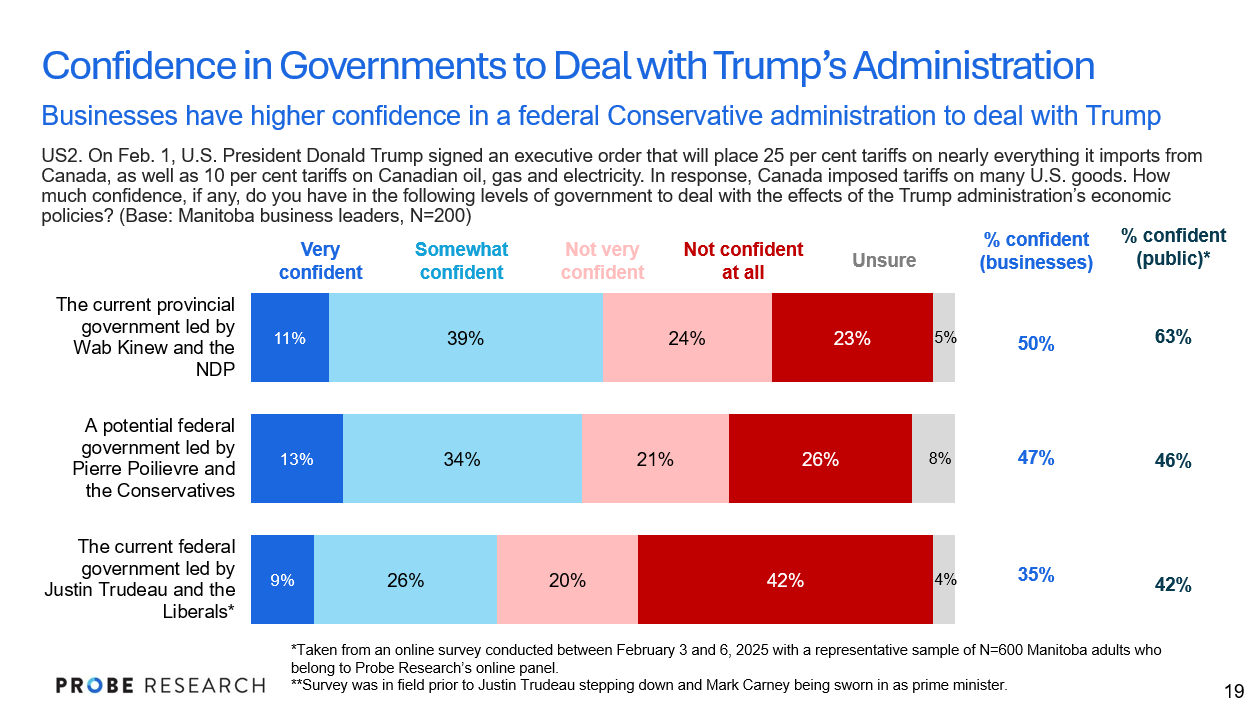

Manitoba businesses are not bullish on the provincial government when it comes to the economy, but its response to the tariff issue appears to have boosted confidence in it to some degree. Fully one-half of Manitoba businesses (50%) are confident in Premier Wab Kinew and his NDP government’s response to U.S. tariffs. While the public is more confident in the provincial government than businesses, the Manitoba business community has slightly more confidence in the Kinew government than it does in a hypothetical Pierre Poilievre-led federal Conservative government (47%) and significantly more than in the current Liberal federal administration (35%).

When it comes to views on creating a positive climate for business, nearly three in 10 now indicate the provincial government does an excellent or good job in this regard (28%, up from 18% in 2024), while one-quarter say the same about their local government (26%, down from 28%) or the federal government (20%, up from 14%).

![]()

About the Manitoba Business Leaders Survey

The Manitoba Business Leaders Survey (MBLS) is an annual scientific survey of senior business officials from across the province and has been conducted for more than 20 years. The survey sample includes a stratified sampling of CEOs, presidents, business owners and designated senior corporate officers from small, mid-sized and large commercial establishments as defined by Statistics Canada and the Manitoba Bureau of Statistics. This business sampling includes publicly traded and private companies from all major sectors of Manitoba industry. Business listings have been developed based upon the most authoritative and up-to-date sampling sources available including various telephone directories.

Methodology

Probe Research conducted a survey of 200 business owners and managers located throughout Manitoba between February 4 and March 12, 2024. Respondents were contacted via telephone and completed the survey via telephone with a live interviewer or via a secure online survey link.

The survey sample was stratified to ensure representation from small enterprises (1-9 employees), medium-sized companies (10-49 employees) and large businesses (50+ employees). Quotas were also set based on region as well as by business sector (services, manufacturing, resources). The sample does not include government departments/agencies, representatives of other public sector entities or not-for-profit organizations.

With a sample of 200, one can say with 95 per cent certainty that the results are within ± 6.9 percentage points of what they would have been if all private-sector business owners/managers in Manitoba had been surveyed. The margin of error is higher within each of the survey’s population sub-groups.

All data analysis was performed using SPSS statistical analysis software. Totals may not add to exactly 100% due to rounding.

The survey instrument was designed by Probe Research.

Disclosure Statement

Probe Research is a member of the Canadian Research Insights Council (CRIC) and confirms that this research fully complies with all CRIC Standards including the CRIC Public Opinion Research Standards and Disclosure Requirements. Learn more at: https://www.canadianresearchinsightscouncil.ca/standards/por/